EveryData Automated Identity Verification

A real-time identity verification method that’s as easy as snapping a picture. Simple for your users but extensive enough to prevent fraud and ensure regulatory compliance.

Automated Identity Verification

A real-time identity verification method that's as simple as snapping a picture, yet comprehensive enough to effectively thwart fraud and guarantee adherence to regulatory requirements

Ease-Of-Use

Enhance conversions with a user-friendly UX. Redirect verification issues to another device if they arise

Safety

Blend AI and human expertise. Automate data capture with AI, detect anomalies, and have specialists review

Speed

Cut the time that your client has to spend when onboarding and get every bit of data that you need in under 60 seconds

Easier KYC Process for Everyone

Effortless Onboarding with AI

Our system employs machine learning to detect and prevent spoofing attempts, continually adapting to new threats.

OCR: Streamline Data Entry

Our AI verifies user identities by cross-referencing IDs with facial recognition, bolstering security and user confidence.

Biometric Face Matching

KYC specialists serve as the final checkpoint, ensuring verification accuracy and reliability.

OCR: Streamline Data Entry

Our AI verifies user identities by cross-referencing IDs with facial recognition, bolstering security and user confidence.

Comprehensive Customer Overview

Initial ID Checks

Make your onboarding effortless and engaging by leveraging the power of AI. Our advanced solutions are designed to simplify and enhance the onboarding experience for your customers.

AI-Powered IP Address Analysis

Eliminate the hassle of manual form filling with our state-of-the-art OCR technology. Say goodbye to time-consuming data entry tasks and allow your customers to breeze through the onboarding process.

Comprehensive Screening

Boost security measures by implementing biometric face matching technology. This ensures that the person presenting the document matches the data within, adding an extra layer of identity verification to your onboarding process.

Four Eyes Principle

ML Spoofing Detection

Our system employs machine learning to detect and prevent spoofing attempts, continually adapting to new threats.

ID-User Face Matching with AI

Our AI verifies user identities by cross-referencing IDs with facial recognition, bolstering security and user confidence.

Human Oversight in KYC

While AI drives our verification process, our KYC specialists provide essential human oversight.

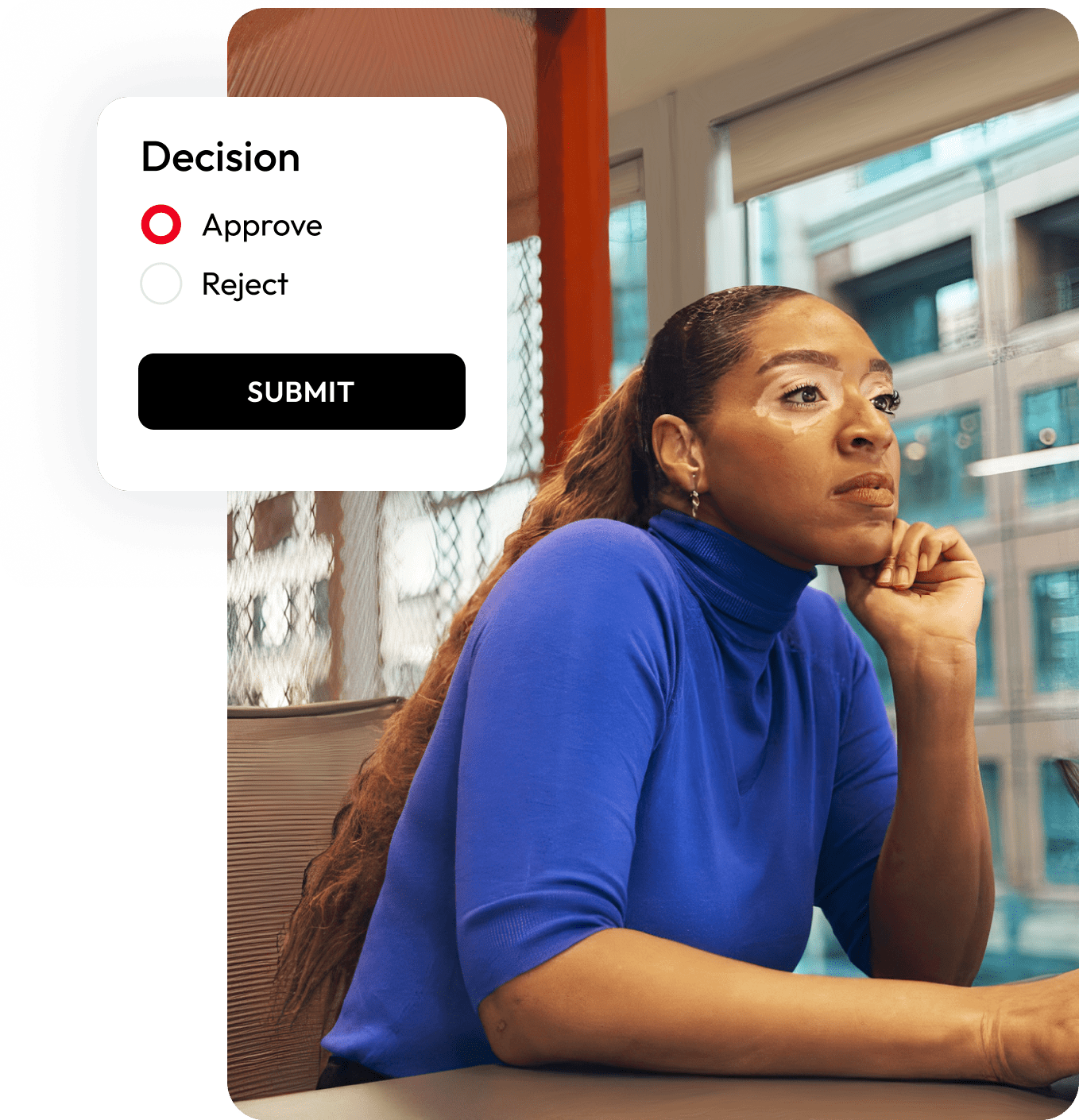

Final Confirmation

KYC specialists serve as the final checkpoint, ensuring verification accuracy and reliability.

Get a white-label lending platform that helps re-think the onboarding process. The SaaS lending system is adaptive for both desktop and mobile users

Book a DemoDigital Customer Onboarding

1. ID Data Extraction

The user uploads a selfie and ID document to our cloud. Our AI validates the information and cross-references it with registries

2. Triple Matching

If the ID is genuine and the biometric data analysis confirms its authenticity, comparing them halfway approves the verification request

3. Background Analysis

The gathered data is then automatically cross-referenced with sanctions, adverse media, and politically exposed person's screening lists: both in-house and external

4. Wrapping Up

All accumulated information is then given to the dedicated KYC compliance specialist that adds a final confirmation to approve or deny your verification request

eKYC Customizable Features

Selfie/Liveness

- Video Selfie Capture

- Liveness Check

ID Verify

- Drivers License

- Voters/National ID

- Passport

AML Checks

- AML

- PEP

- Adverse Media

Additional Docs

- Proof of Address

- Salary Slip

- Occupation Letter

- Referral Letter

Decisioning

- eKYC Decision Engine

- On-boarding API

- Webhook

.png?width=345&height=207&name=1367150229_s_auto_x2%201%20(1).png)

Feel Free to Reach Out to Us

- 3 easy steps to digitize user onboarding

- Achieve user onboarding in under 3 minutes

- Live selfie video with human presence

- Lower cost for compliance

- Fully customizable (tiered KYC)

- Improved NPS